ProPublica is a Pulitzer Prize-winning investigative newsroom. Sign up for The Big Story newsletter to receive stories like this one in your inbox.

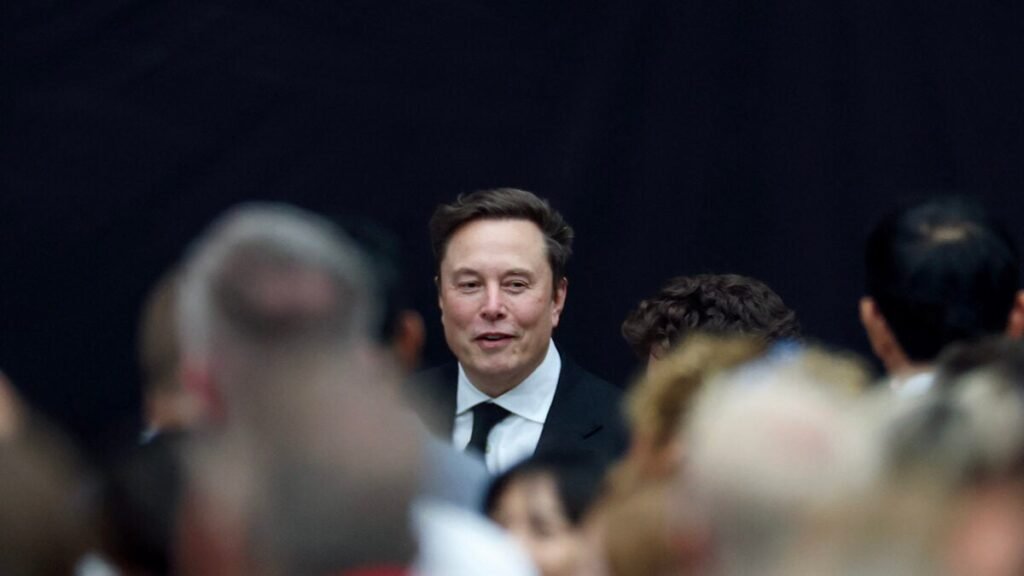

Elon Musk’s SpaceX has taken money directly from Chinese investors, according to previously sealed testimony, raising new questions about foreign ownership interests in one of the United States’ most important military contractors.

The recent testimony, coming from a SpaceX insider during a court case, marks the first time direct Chinese investment in the privately held company has been disclosed. While there is no prohibition on Chinese ownership in U.S. military contractors, such investment is heavily regulated, and the issue is treated by the U.S. government as a significant national security concern.

“They obviously have Chinese investors to be honest,” Iqbaljit Kahlon, a major SpaceX investor, said in a deposition last year, adding that some are “directly on the cap table.” “Cap table” refers to the company’s capitalization table, which lists its shareholders.

Kahlon’s testimony does not reveal the scope of Chinese investment in SpaceX or the identities of the investors. Kahlon has long been close with the company’s leadership and runs his own firm that acts as a middleman for wealthy investors looking to buy shares of SpaceX.

SpaceX keeps its full ownership structure secret. It was previously reported that some Chinese investors had bought indirect stakes in SpaceX, investing in middleman funds that in turn owned shares in the rocket company. The new testimony describes direct investments that suggest a closer relationship with SpaceX.

SpaceX has thrived as it snaps up sensitive U.S. government contracts, from building spy satellites for the Pentagon to launching spacecraft for NASA. U.S. embassies and the White House have connected to the company’s Starlink internet service too. Musk’s roughly 42% stake in the company is worth an estimated $168 billion. If he owned nothing else, he’d be one of the 10 richest people in the world.

National security law experts said federal officials would likely be deeply interested in understanding the direct Chinese investment in SpaceX. Whether there was cause for concern would depend on the details, they said, but the U.S. government has asserted that China has a systematic strategy of using investments in sensitive industries to conduct espionage.

If the investors got access to nonpublic information about the company — say, details on its contracts or supply chain — it could be useful to Chinese intelligence, said Sarah Bauerle Danzman, an Indiana University professor who has worked for the State Department scrutinizing foreign investments. That “would create huge risks that, if realized, would have huge consequences for national security,” she said.

SpaceX did not respond to questions for this story. Kahlon declined to comment.

The new court records come from litigation in Delaware between Kahlon and another investor. The testimony was sealed until ProPublica, with the assistance of lawyers at the Reporters Committee for Freedom of the Press and the law firm Shaw Keller, moved in the spring to make it public. SpaceX fought the effort, but a judge ruled that some of the records must be released. Kahlon’s testimony was publicly filed this week.

Buying shares in SpaceX is much more difficult than buying a piece of a publicly traded company like Tesla or Microsoft. SpaceX has control over who can buy stakes in it, and the company’s investors fall into different categories. The most rarefied group is the direct investors, who actually own SpaceX shares. This group includes funds led by Kahlon, Peter Thiel, and a handful of other venture capitalists with personal ties to Musk. Then there are the indirect investors, who effectively buy stakes in SpaceX through a middleman like Kahlon. (The indirect investors are actually buying into a fund run by the middleman, typically paying a hefty fee.) All previously known Chinese investors in SpaceX fell into the latter category.

This year, ProPublica reported on an unusual feature of SpaceX’s approach to investment from China. According to testimony from the Delaware case, the company allows Chinese investors to buy stakes in SpaceX so long as the money is routed through the Cayman Islands or other offshore secrecy hubs. Companies only have to proactively report Chinese investments to the government in limited circumstances, and there aren’t hard and fast rules for how much is too much.

After ProPublica’s report, House Democrats sent a letter to Defense Secretary Pete Hegseth raising alarms about the company’s “potential obfuscation.” “In light of the extreme sensitivity of SpaceX’s work for DoD and NASA, this lack of transparency raises serious questions,” they wrote. It’s unclear if any action was taken in response.

Kahlon has turned his access to SpaceX stock into a lucrative business. His investor list reads like an atlas of the world. The investors’ names are redacted in the recently unsealed document, but their addresses span from Chile to Malaysia. One is in Russia. At least two are in mainland China. One is in Qatar. (In one email to SpaceX’s chief financial officer, Kahlon said a Los Angeles-based fund had money from the Qatari royal family and was already invested in SpaceX.)

“You made a big fortune,” a China-based financier wrote to Kahlon four years ago. “Lol something like that. SpaceX has been the gift that keeps on giving,” Kahlon responded. “All thanks to you.”

Kahlon first met with SpaceX when it was a fledgling startup, according to court records. SpaceX’s CFO, Bret Johnsen, who’s been there for 14 years, testified that Kahlon “has been with the company in one form or fashion longer than I have.” Johnsen also testified that SpaceX has no formal policy about accepting investments from countries deemed adversaries by the U.S. government. But he said he asks fund managers to “stay away from Russian, Chinese, Iranian, North Korean ownership interest” because that could make it “more challenging to win government contracts.”

There are indications that by 2021, Kahlon was wary of raising funds from China. The U.S. government had grown increasingly concerned about Chinese investments in tech companies, and that June, Kahlon told an associate he was “being picky” with who he’d let buy into a new SpaceX opportunity. “Only people I want to have a relationship with long term. No one from mainland China,” Kahlon said.

But as he raced to assemble a pool of investors, those concerns appeared to fade away. By November 2021, Kahlon was personally raising money from China to buy SpaceX stakes. He told a Shanghai-based company that if it invested with him, it would get quarterly updates on SpaceX’s business development, “visits to SpaceX, and the opportunities to interview with Space X’s CFO,” court records show.

The Shanghai company ultimately sent Kahlon $50 million to invest in Musk’s business, according to court records. SpaceX had the deal canceled after the plan became public.

Do you have any information we should know about Elon Musk’s businesses? Justin Elliott can be reached by email at [email protected] and by Signal or WhatsApp at 774-826-6240. Josh Kaplan can be reached by email at [email protected] and by Signal or WhatsApp at 734-834-9383.